- All

- Car Purchases

- Charitable Giving

- ClearLogic in the Press

- Credit & Financing

- Discretionary Spending

- Estate Planning

- Family Gifting

- Federal

- Federal Benefits

- Federal Employees

- Federal Retirees

- Financial Planning

- Insurance

- Investment Choices

- Lifestyle

- Market Reviews

- Medicare

- Planning

- Retirement

- Retirement Timing

- Saving Approaches

- Savings Consolidation

- Second Home

- Social Security

- Spending Plans

- Taking Distributions

- Tax Planning

- Travel

Quarterly Market Review: 2020-3Q

Equity markets around the globe posted positive returns in the third quarter. Looking at broad market indices, emerging markets equities outperformed US and non-US developed markets for the quarter.

SEE MORE

Quarterly Market Review: 2020-2Q

Equity markets around the globe posted positive returns in the second quarter. Looking at broad market indices, US equities outperformed non-US developed markets and emerging markets.

SEE MORE

Quarterly Market Review: 2020-1Q

Equity markets around the globe posted negative returns in the first quarter. Looking at broad market indices, US equities outperformed non-US developed markets and emerging markets.

SEE MORE

Quarterly Market Review: 2019-4Q

Equities performed well across most of the markets, with global real estate lagging in the fourth quarter. Value stocks underperformed growth stocks, while small cap stocks outperformed large cap stocks. Overall returns for 2019 represent a significant bounce back from the losses of 2018.

SEE MORE

Quarterly Market Review: 2019-3Q

US Equities outperformed both non-US developed and emerging markets in the third quarter. Value stocks outperformed growth stocks in the US for small cap stocks, but not for large cap stocks.

SEE MORE

Quarterly Market Review: 2019-Q2

Equity markets around the globe posted positive returns for the quarter. Looking at broad market indices, US equities outperformed non-US developed and emerging markets during the quarter.

SEE MORE

Quarterly Market Review: 2019-Q1

After a downward turn in the fourth quarter of 2018, the first quarter of 2019 has been very positive across all markets. By staying the course, the losses experienced in 2018 were largely reversed in the beginning of 2019.

SEE MORE

Quarterly Market Review: 2018-Q4

As shown in the charts for the fourth quarter of 2018 and the year as a whole, 2018 was a difficult one for equity investment returns across the board.

SEE MORE

Quarterly Market Review: 2018-Q3

After a period of relative calm in the markets, in recent days the increase in volatility in the stock market has resulted in renewed anxiety for many investors. From September 30–October 10, the US market (as measured by the Russell 3000 Index) fell 4.8%, resulting in many investors wondering what the future holds and if they should make changes to their portfolios.

SEE MORE

Quarterly Market Review: 2018-Q2

The second quarter of 2018 saw positive returns from the US stock and global real estate markets. Both international developed and emerging market stocks were down, while bonds remained mostly flat. This is another good reminder that US and international stocks do not always move together, making a long-term, globally diversified approach a worthwhile one.

SEE MORE

Quarterly Market Review: 2018-Q1

After a very positive - and in many ways, surprisingly calm - year in the markets in 2017, 2018 has gotten off to a more volatile start. While markets were mostly down at the end of the first quarter, there have already been five weeks in 2018 which produced higher performance than any week in all of 2017. There have also been four weeks which produced lower performance than any week in 2017.

READ MORE

Quarterly Market Review: 2017-Q4

For the fifth quarter in a row (Q4 2016 through Q4 2017), US stocks, international developed stocks, emerging markets stocks, and global real estate investments have been up. For the third quarter in a row (Q2 2017 through Q4 2017), both stocks and bonds have been up. Additionally, for the first three quarters of 2017 we saw both international developed and emerging market stocks outperform US stocks. In Q4 2017, emerging market stocks continued to outperform US stocks.

READ MORE

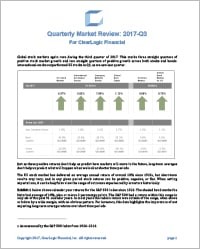

Quarterly Market Review: 2017-Q3

Global stock markets again rose during the third quarter of 2017. This marks three straight quarters of positive stock market growth and two straight quarters of positive growth across both stocks and bonds. International stocks outperformed US stocks in Q3, as we saw last quarter.

READ MORE

Quarterly Market Review: 2017-Q2

Global stock markets again rose during the second quarter of 2017. Additionally, both US and international bond markets were up, making the second quarter of 2017 positive across the board. Last quarter, we noted that international stock markets outperformed US stock markets, reversing a trend we had seen over the past few years. The reversal continued this quarter with international stocks returning about double what the US stock market returned.

READ MORE

Part B Or Not Part B – That Is The Medicare Question For Federal Retirees With Healthy Retirement Incomes

Federal retirees with healthy retirement incomes are in a unique position when it comes to health insurance.

On the surface, Medicare Part B appears attractive, because you most likely will not incur any co-pays or co-insurance costs with your Federal Employee Health Benefit [FEHB] plan.

READ MORE

Quarterly Market Review: 2017-Q1

Global markets rose sharply this quarter and international stocks outperformed US stocks reversing the trend of the last seven years.

Only international bonds showed negative returns this quarter out of all of CLearLogic’s portfolio funds. Our role as investment managers is sometimes more difficult when US stock markets perform very well ...

READ MORE

Quarterly Market Review: 2016-Q4

The 4th quarter market returns below may surprise you. Here in the U.S., Donald Trump’s victory dominated the news. In the financial news, the unexpected rise of the markets post-Trump victory was the top story. But as you can see below, only the U.S. stock market increased. All other markets in a diversified portfolio decreased, and some quite substantially.

READ MORE

ClearLogic Investment Principles

Embrace market pricing

The market is an effective, information-processing machine. Millions of participants buy and sell securities in the world markets every day, and the real-time information they bring helps set prices.

READ MORE

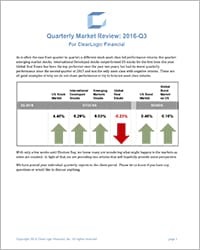

Quarterly Market Review: 2016-Q3

As is often the case from quarter to quarter, a different stock asset class led performance returns this quarter: emerging market stocks. International Developed stocks outperformed US stocks for the first time this year. Global Real Estate has been the top performer over the past two years, but had its worst quarterly performance since the second quarter of 2015 and was the only asset class with negative returns. These are all good examples of why we do not chase performance or try to forecast asset class returns.

READ MORE

Cost Control - An Investor's Greatest Investment

In the mid-1800s, in a collection of essays entitled “Conduct of Life,” Ralph Waldo Emerson observed, “Money often costs too much.” More than 150 years later, his words remain well worth heeding, as we focus on one of the most effective ways to enhance your wealth: aggressively eliminating unnecessary investment costs.

READ MORE